Treasury Auction Explained

Upcoming Auctions: https://treasurydirect.gov/auctions/upcoming/

US Treasuries: They are interest-bearing financial assets that have virtually no risk. Many private citizens and institutions want to purchase them, including pensions and mutual funds.

Treasury Auctions: The US Treasury has been using auctions to sell Treasuries since 1929. This method of selling has evolved considerably over the years. These are multi-unit auctions.

Bidding Types:

Non-competitive bids:

Bidders agree to accept whatever yield is determined at the auction. These bidders are guaranteed to receive the full amount of the security they bid for.

Competitive bids:

Bidders specify the yield they are willing to accept. There's no guarantee they will receive the security, especially if their specified yield is lower than the yield determined at auction.

Larger financial institutions typically use this because they often want more than five million dollars worth.

Single Price System: Regardless of the interest rate each competitive bidder offers, all winning bidders receive the same interest rate, determined by the lowest accepted competitive bid.

High Yield:

Determining the High Yield: Bids are arranged in descending order based on the yield specified in competitive bids. The Treasury will start accepting bids with the highest yields first. The "high yield" is the yield of the last accepted competitive bid. It sets the yield for all of the awarded securities in that auction.

All Bidders at the High Yield Receive the Same Rate: All winning bidders, whether they submitted competitive or non-competitive bids, receive the securities at the high yield determined by the auction. This means if you submit a non-competitive bid or a competitive bid with a yield lower than the high yield, you'll get the security at the high yield rate.

Example:

For an auction of 24 billion in securities, if non-competitive bids total 1 billion dollars, there are 23 billion dollars worth left for competitive bids.

Bids are accepted from lowest interest rate and amount upwards.

The final interest rate set by the last accepted competitive bid becomes the standard rate for all winning bidders.

US Treasuries Demand: Treasuries are considered a no-risk, interest-bearing investment. It's challenging to envision a situation where no one would want to purchase them.

Federal Reserve's Role: The Federal Reserve (Fed) targets interest rates and manages US currency. They control interest rates by managing reserves held by banks through buying and selling assets, primarily US Treasuries. The Fed is a stable demand source in Treasury auctions due to the constant maturing of their held Treasuries.

Primary Dealer System: Primary dealers are large financial institutions that deal directly with the Federal Reserve Bank. They are legally required to submit bids in every Treasury auction, ensuring that bids are always placed. If a primary dealer lacks funds, the Fed will buy some older Treasuries from them, providing them with the needed reserves to bid in the auction. This system acts as a mediator between the Treasury and the Fed.

Auction Schedule:

Example - https://home.treasury.gov/system/files/221/Tentative-Auction-Schedule.pdf

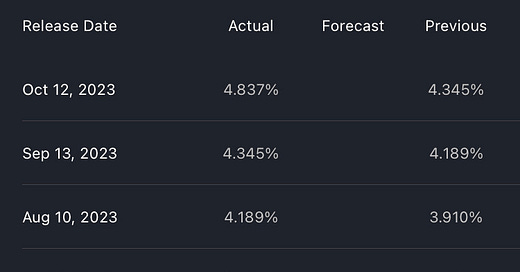

30y Treasury Auction since March:

Upcoming (10/18/23) 20r auction

Offering Amount: $13B

Competitive Closing Time: 1pm ET

Reopening/Original Issue:

"Reopening" in the context of a U.S. Treasury auction refers to the Treasury's practice of issuing additional amounts of a previously issued security. The reopened security has the same maturity date and coupon interest rate as the original security, but it can be purchased at a different yield and thus a different price.

Here's a breakdown:

Original Issue: The Treasury issues a security (like a note, bond, or bill) with a specific maturity date and coupon interest rate. This is the initial or original issuance.

Reopening: At a later date, the Treasury may decide to issue more of that same security. This is called a reopening. The reopened security will have the same maturity date and coupon rate as the original issue. However, the price (and hence the yield) might differ based on prevailing market conditions at the time of the reopening.

Why Reopen?: Reopenings provide flexibility to the Treasury in managing its financing needs. Instead of creating a new security with a different maturity or coupon rate, the Treasury can simply issue more of an existing security. This can also help to enhance the liquidity of that security in the secondary market because there's more of it available for trading.

Post Auction

Offered Amount: This is the total amount of a specific Treasury security (like Treasury bills, notes, or bonds) that the U.S. Department of the Treasury announces it will auction off on a specific date. Essentially, it represents how much the government is willing to sell in that particular auction.

Accepted Amount: After bids are made by primary dealers and other participants, the U.S. Department of the Treasury will decide which bids to accept. The sum of the face values of all accepted bids represents the "accepted amount." This amount can be less than, equal to, or (in the case of over-subscription where non-competitive bids are also involved) even greater than the offered amount.

Tendered Amount: This is the cumulative value of all bids made by participants in the auction. It signifies the total interest or demand for the security that's being auctioned.

The difference between the two can be due to various reasons:

Demand: If the demand for a particular security is low, the accepted amount might be less than the offered amount because there aren't enough bids at rates that the Treasury is willing to accept.

Target Amount: Sometimes, the Treasury might have a target amount they aim to raise from an auction, which might be less than the total amount of bids they receive. In such cases, they would accept only the bids that allow them to raise the target amount.

Bid Rates: The Treasury might receive bids at a variety of interest rates (or discount rates for T-bills). They will usually accept bids starting from the lowest rates and going up until they've met their fundraising target for that auction or have accepted all the bids. If the offered amount isn't fully met by bids at rates the Treasury deems acceptable, then the accepted amount can be less than the offered amount.

Example: 20yr auction on 10/18/2023

TBA..